Detroit Development Fund revitalizes neighborhoods with ‘character lending’

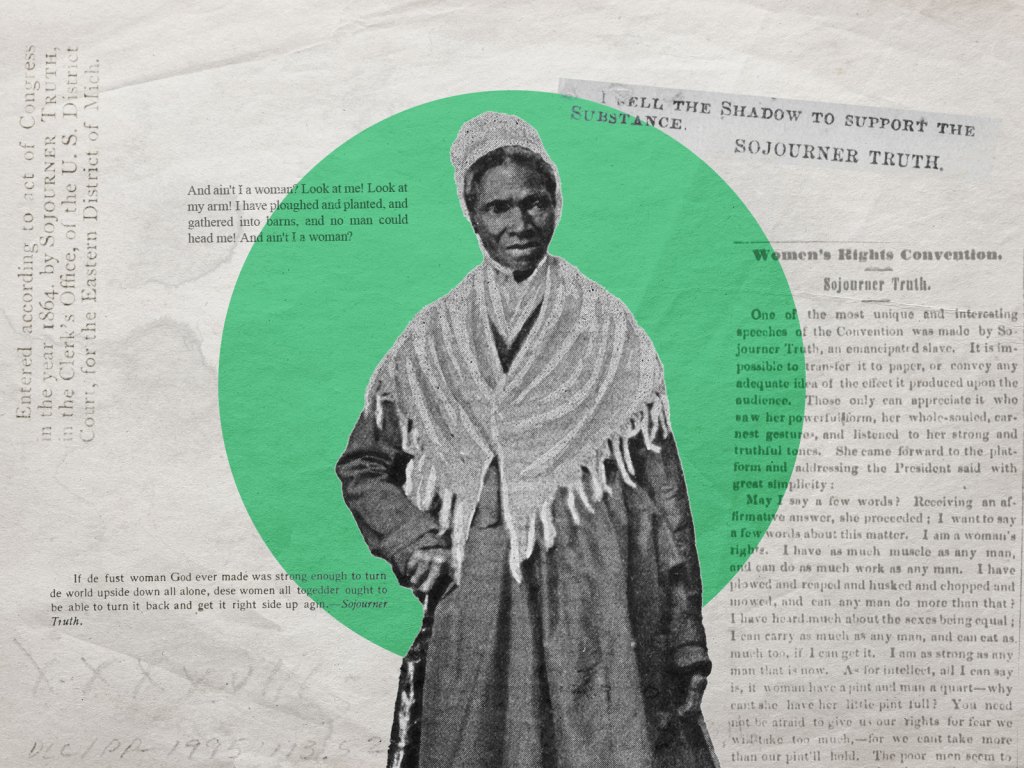

Above: Ayanna Williams-Jones, owner of Pedicure & Shoes 2 Go, also received an award from Motor City Match, a Knight-funded program that matches business owners with properties. Photo by Shawn Le/Courtesy Detroit Economic Growth Corp.

Convincing a skeptical landlord that women like pedicures and new shoes, ideally in combination, was far more difficult for Ayanna Williams-Jones than getting a loan to open her business in downtown Detroit.

Seriously.

The Detroit Development Fund took a chance on Williams-Jones, despite her having a personal bankruptcy in her past, loaning her $40,000 to help open Pedicure & Shoes 2 Go on Congress Street, not far from the Joe Louis Arena.

But it was also Williams-Jones’ perseverance that inspired confidence. The Great Recession had gutted her family’s savings, and her husband, Eric Jones, lost his job, forcing them to declare personal bankruptcy. In 2013, Williams-Jones put herself through an entrepreneurial boot camp and pitched the idea for her store in front of Ray Waters, president of the fund. He connected her with Lifeline Consulting, a business coach that helped her put together a solid plan that reflected her competence.

Waters also saw that Williams-Jones was working herself back to financial solvency – even if her credit score wasn’t good enough to qualify for a loan from a traditional bank. He put her in touch with the Detroit Microenterprise Fund, a Detroit Development Fund partnership with Huntington Bank, and it loaned her $20,000. Then the Detroit Development Fund came in with $40,000.

Williams-Jones “plugged away,” says Waters. He met with the couple, explored the reasons behind the bankruptcy, and was satisfied that they could meet the loan payments.

Williams-Jones, 38, put up her house as collateral. She plans to continue working as an analyst at GM full time, while her sister, Kendra Patterson, manages the business. “We spent time with her and watched her move through the last two years,” Waters says. “She persevered and remained upbeat even with so many challenges. You have to get to know somebody. This is a character lending.”

This is also enlightened self-interest, an idealist’s vision of what capitalism should be. As one of a handful of community development funding institutions in Detroit—CDFIs lend credit to underserved and distressed communities to promote economic development—the fund is seeing big success in small and large ventures, from the shoe store to restaurants to major and modest housing developments (more than 1,400 units). Its investments have generated 1,800 jobs and kept another 1,200 in place, Waters says.

The fund’s focus and its commitment to minority business development is the central reason it has the support of Knight Foundation, which recently announced its conversion of a $2.5 million loan to the fund to a grant. By removing the debt from the books, Knight is helping strengthen the fund’s lending power, says Katy Locker, Knight’s program director in Detroit.

“While there are increasingly new lenders arriving in Detroit’s marketplace as we get more investment interest from across the country, there are only a few CDFIs in Detroit that have been here and know our community well,” Locker. “They have survived the boom and the bust we have seen in the last 10 to 15 years and I think it matters to have that local context.”

Marisa Garcia at Tijuana’s Authentic Mexican Kitchen. Photo courtesy the W.K. Kellogg Foundation.

The conversion of the 2006 loan will unlock $7 million in additional loans by 2020, says Waters, helping people like Marisa Garcia, who also received a character-based loan. Garcia sought funds to help her buy back the original location of Tijuana’s Authentic Mexican Kitchen in Detroit three years ago. Garcia’s ex-husband received the property in the divorce more than a dozen years ago and then offered to resell it to her. But she had opened two other locations of the restaurant and needed capital. She turned to the Detroit Development Fund.

“I’m glad they took a chance on me; they became like a partner of mine as opposed to a lending company,’’ says Garcia. “Because of that $130,000 investment in us, it’s given us an opportunity to hopefully grow more stores, hopefully in Detroit.”

Community collaboration

The CDFIs that are focused on Detroit often work together or in tandem with other community development organizations.

“I see a tremendous amount of collaboration in Detroit that I didn’t see five years ago,” Waters says. “It’s not going to cure it tomorrow, but now that Detroit has gotten out of bankruptcy, the mayor is organized, we’ve seen more businesses coming in the door. We’re going to see more vibrant neighborhoods.”

Since Waters became head of the Detroit Development Fund in 2004, the fund has been able, with the help of banks such as Huntington, Goldman Sachs, JP Morgan Chase and foundations such as Knight, Ford, Kellogg and Kresge, to raise some $42 million, he says.

The fund has lent about $35 million since he took over the helm of the fund; 78 percent of the fund’s small business loans are to minority- and women-owned companies. The loan write-off percentage is around 4 percent, which Waters considers pretty healthy for the risk the fund takes.

Waters, a soft-spoken Spokane, Wash., native, has a business background and ran a private equity firm before coming to the fund. He joined 11 years ago – after folks at another community development financer, Invest Detroit, convinced him he could do some good in the city, which was at the time far from a smart bet for investors.

Waters, says Dave Blaszkiewicz, president and CEO of Invest Detroit, “has been a terrific partner” in various real estate ventures, many of them risky. He’s also led the way in investing outside of the downtown area to stimulate neglected but viable neighborhoods.

“We have the benefit of his experience,” says Blaszkiewicz. “Ray is showing us the way when it comes to neighborhoods.”

‘Filling the gap’

Invest Detroit, with some $125 million in assets, is looking at the West Village, where the Detroit Development Fund helped seed a startup restaurant and coffee shop, and in areas in southwest and northwest Detroit.

Video: Grandmont Rosedale on YouTube

Waters has particular affection for the work of the Grandmont Rosedale Development Corp., a nonprofit that has bought, rehabbed and resold around 100 single-family homes in a cluster of five neighborhoods on Detroit’s west side, with a lot of help from the Detroit Development Fund. Grandmont Director Tom Goddeeris says the Detroit Development Fund backed his efforts during one of the nation’s worst foreclosure crises in 2008-09. It also managed a down payment assistance program at the time that ensured that new buyers were successful. That, adds Goddeeris, was a critical piece of the program.

“It was difficult to get a loan from a bank to do anything, certainly not housing renovations,” he says. “At the time, the DDF was filling the gap. I don’t know that anyone else would have considered giving us a loan.”

Waters brings to mind George Bailey of “It’s a Wonderful Life,” without all that character’s regret over what could have been.

“It’s not as easy as it sounds,” he cautions. “It’s a high-touch business.”

Julie Edgar is a Detroit-based freelancer. Email her at [email protected].

Recent Content

-

Community Impactarticle ·

-

Community Impactarticle ·

-

Community Impactarticle ·